Low MOQ Mixed-Container Plan for Decorative Film Distributors in the Middle East

- Dora

- Nov 10, 2025

- 5 min read

Start fast with trial orders, mix SKUs in one container, and reduce inventory risk—ideal for new market validation.

Executive Summary (for decision-makers)

What you get: Faster market entry, broader SKU coverage per shipment, and lower working-capital risk without sacrificing brand consistency.

Why it matters: In fast-moving Middle East markets, distributors win by testing more textures and sizes early, then doubling down on verified best-sellers.

How to start: Use a Low-MOQ + Mixed-Container plan for the first 1–2 shipments, pair it with a 90-day replenishment rhythm, and track three KPIs: sell-through, days-on-hand, and repeat rate.

The B2B Case for Low MOQ & Mixed Loading

Distributors in décor surfaces face a classic launch dilemma: you need variety to win projects, yet committing deep stock to unproven SKUs risks slow turns. A Low-MOQ + Mixed-Container strategy solves this by spreading risk across wood, stone, and metal looks, gloss levels, and widths; validating demand in kitchens, doors, profile wrapping, and retail refit segments; and feeding the sales funnel with more showroom boards and project samples without ballooning inventory. This approach keeps you agile in GCC procurement cycles where project approvals and seasonal peaks can shift SKU demand quickly.

What “Low MOQ” Means in Practice

Low MOQ is flexible by SKU. Texture complexity, finish, and width may influence the minimum. For planning purposes, treat low MOQ as illustrative ranges customized during quotation. Use category bundles that include a base set of best-sellers plus a rotating set of “trial SKUs.” Run purpose-built pilots for cabinet doors, profile wrapping, or steel lamination. Treat the first two shipments as market experiments, measure which SKUs generate 80% of quotes, then promote those to your “A-List.”

How Mixed-Container Loading Works (Step-by-Step)

Step 1: Define demand buckets for Cabinets, Doors, Profiles, and Commercial fit-out.

Step 2: Select textures and finishes for each bucket such as warm oak, walnut, high-gloss marble, and brushed metal.

Step 3: Allocate widths such as 1220 mm and 1400 mm families to match downstream processes.

Step 4: Prioritize A, B, and C sets. A (top sellers) around 50–60% of volume, B (strong contenders) around 25–35%, and C (trials) around 10–20%.

Step 5: Consolidate SKUs into one container with clear palletization, labels, and packing lists to accelerate receiving.

Step 6: Book sampling extras such as swatch books, A3 or A4 sample boards, and POS kits aligned to the container mix.

Recommended First-Shipment Mix (Template)

Bucket | Target Use Case | Finish | Width | Share of Container | Notes |

A1 Woodgrain | Kitchens/Cabinets | Matte/Satin | 1220 | 25% | Warm oak, walnut; safe bets for retail and projects |

A2 Woodgrain | Doors and Panels | Matte | 1400 | 20% | Neutral oaks for broad appeal |

B1 Stone | Commercial/Hotels | High-Gloss | 1220 | 15% | Marble looks for reception and retail |

B2 Stone | Retail Refit | Silk/Satin | 1220 | 10% | Terrazzo or light stone accents |

B3 Metal | Profiles and Trims | Brushed | 1220 | 10% | Gold, silver, gunmetal; consider anti-fingerprint |

C1 Trend | Design Trials | Mixed | Mixed | 10% | Seasonal trials; rotate quarterly |

C2 Local Picks | Market-specific | Mixed | Mixed | 10% | Dealer selections based on architect requests |

Replenishment & Inventory Playbook

Adopt a 90-day rolling demand plan with monthly checks. Hold 2–3 weeks of safety stock for A-List SKUs; keep B and C SKUs on just-in-time replenishment. Feature last quarter’s winners in your next mixed container.

KPIs to Track Weekly

KPI | Target Guideline | Why it matters |

Sell-through % | Greater than 65% by Day 90 | Validates your mix and pricing |

Days on Hand | A: 20–35; B: 30–45; C: 30 or less | Balances availability versus cash |

Repeat Rate (A-List) | Greater than 40% within 120 days | Indicates true market fit |

Dead Stock Ratio | Less than 5% of inventory | Keeps warehouse lean |

Quote-to-Win (Projects) | Greater than 30% | Ensures focus on winnable bids |

QA/QC & Labeling for Multi-SKU Loads

Color consistency: Batch-to-batch targets and retained samples protect repeat orders.

Adhesion and process fit: Match films to substrates such as MDF, plywood, aluminum profiles, and steel with the right primers or lamination windows.

Finish integrity: Scratch and stain resistance aligned to kitchens, retail, and hotel traffic.

Dual-language labels: Include SKU, finish, width, meters, and handling notes in English and Arabic to speed receiving and reduce errors.

Collaterals: Swatch books, A3 or A4 sample boards, and POS kits aligned to the container mix reduce the sales cycle.

QA/QC Focus Points (Example)

Control Point | Method or Metric | Target or Commitment |

Color Consistency | Delta-E (CIELAB) against master standard | ≤ 1.0–1.5 target for mass production |

Adhesion | Cross-hatch or peel strength | Meets substrate-specific requirements |

Scratch Resistance | Steel wool or load scratch test | Kitchen and commercial grade |

Stain Resistance | Common cleaners and staining agents | Wipe-clean without visible residue |

Anti-yellowing/UV | UV exposure or accelerated aging | Pass grade for desert climate |

Traceability | Retained samples for key batches | 12–24 months availability |

Documentation | ASTM, EN, VOC summaries | Reports and highlights on request |

Logistics & Documentation Essentials

Ports and Incoterms: CIF, FOB, or CFR to Jebel Ali, Dammam, Doha, and other GCC ports.

Consolidation: LCL or FCL with mixed SKUs. Ensure each pallet’s packing list matches your receiving sheet.

Documentation pack: Commercial invoice, packing list, certificate of origin, and compliance summaries where applicable.

Scheduling: Lock production slots ahead of seasonal peaks and maintain a shipment calendar with buffers.

Risk Controls, KPIs & Reporting

Risk controls include A, B, and C allocations to cap exposure to unproven SKUs, MAP and pricing discipline to maintain channel health, quarterly mix reviews to promote winners and retire laggards, and an exceptions log for any receiving or field issues.

Reporting Pack (Template)

Report | Frequency | Owner | Key Fields |

Sell-through and Days on Hand | Weekly | Distributor | SKU sales, stock, days on hand |

Project Pipeline | Bi-weekly | Sales Lead | Stage, value, specified SKUs |

Returns and Claims | Monthly | QA | Root cause, corrective action |

Mix Optimization | Quarterly | Joint | A, B, C changes, new trials |

Frequently Asked Questions (FAQ)

Q1. What if I don’t know which SKUs will sell?

Answer: Start with a balanced mix of 50–60% proven woodgrains, 25–35% stones and metals, and 10–20% trials. After 60–90 days, shift volume into the SKUs with the highest quote frequency and repeat rate.

Q2. Can I run small pilots for cabinets, doors, profiles, or steel lamination?

Answer: Yes. Low-MOQ lots can be tailored to each process. Adhesion systems and processing windows will be aligned with your equipment and substrates.

Q3. How do I avoid stockouts while keeping inventory light?

Answer: Use a 90-day rolling plan, keep A-List SKUs at 2–3 weeks of safety stock, and schedule monthly replenishment checks tied to your container calendar.

Q4. Will mixed containers complicate receiving?

Answer: With clean palletization and labels the process is straightforward. Dual-language labels and SKU-level packing lists enable fast scanning and shelving.

Q5. Can I include OEM or private-label items in the same container?

Answer: Yes. Mixed containers can combine Giwett branded and private-label SKUs. Pallets and documentation will be separated as needed.

Q6. What quality controls protect my reorders?

Answer: Batch-to-batch color targets, retained samples, and process-fit checks for adhesion and durability. Reporting templates help detect and resolve issues early.

Q7. How soon can I scale to exclusivity?

Answer: After two to three successful cycles with clean metrics, we can discuss territory protection and tier upgrades.

Q8. Do you support showroom materials and POS?

Answer: Yes. Swatch books, sample boards, and POS kits are matched to your container mix to shorten the sales cycle.

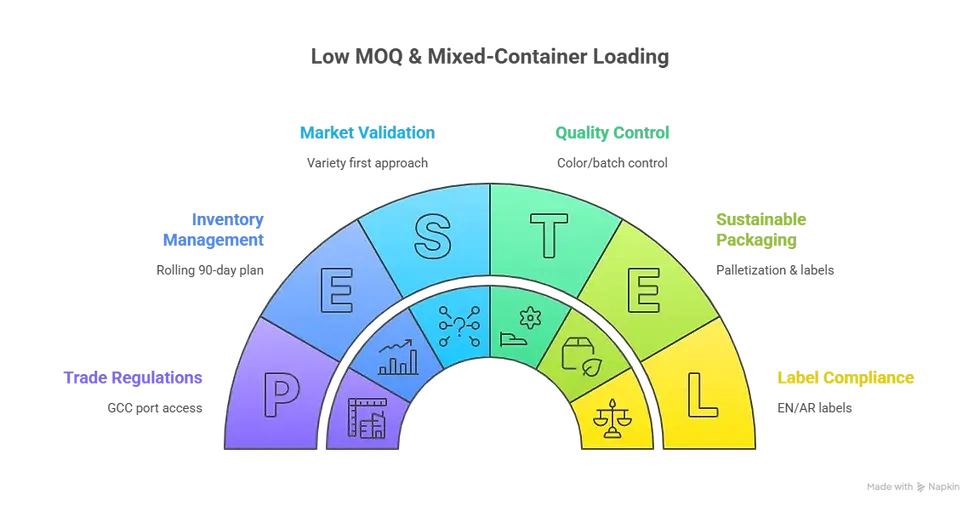

Mind Map (plain text)Low MOQ and Mixed-Container Loading

Comments